You’ll never find me recommending you take out student loans to get an education. But believe it or not, not everyone follows my advice! If you need to refinance your student loans, there are some good options available to help you pay off your student loan debt faster. In this article, I’ll tell you about SoFi, which I believe is one of the best options available for student loan refinancing.

The Student Loan Squeeze

There are literally millions of people who spend years (sometimes decades) trying to pay back crippling student loans. I consistently get emails from people asking how they can pay off their student loans faster so they can put money into savings or buy a house. It’s a financial squeeze affecting millions of people!

That’s why I decided to write this post.

Student Loans are Different

Typically, I’m not a fan of debt consolidation, especially when you consolidate loans by refinancing your home. But that’s a debate for another article.

I believe student loans are a different animal. There are so many student loan lenders who are unscrupulous at worst, or inept at best, that consolidating your loans with a trusted company just makes sense in the long run.

How Can You Pay Off Student Loans Early?

So if you’re burdened with high interest student loan debt, what can you realistically do to pay off your student loans early? Well, as I see it, there are 4 options available:

- Live like a pauper and put every penny you can toward paying extra on your debt.

- Commit years of your life to the military or a service organization willing to pay off your loans.

- Find ways to make extra money you can put exclusively toward your student loans.

- Refinance your student loans to a lower interest rate using a service such as SoFi.

Of course, I’ve written extensively about how to pay off debt and how to make extra money.

In this article I’m going to show you how using SoFi, a popular student loan refinancing company, helps you pay off your student loans early, saving you thousands of dollars in the process!

What is SoFi?

The name SoFi stands for Social Financing. SoFi is not just another loan company- it’s built on the premise that being part of a community can help you succeed in ways you otherwise could not. Here’s a short excerpt directly from their site:

“SoFi is a new kind of finance company taking a radical approach to lending and wealth management. From unprecedented products and tools to faster service and open conversations, we’re all about helping our members get ahead and find success. Whether they’re looking to buy a home, save money on student loans, ascend in their careers, or invest in the future, the SoFi community works to empower our members to accomplish the goals they set and achieve financial greatness as a result.”

Get Started with SoFi here and get a $100 Welcome Bonus!

How Does SoFi Work?

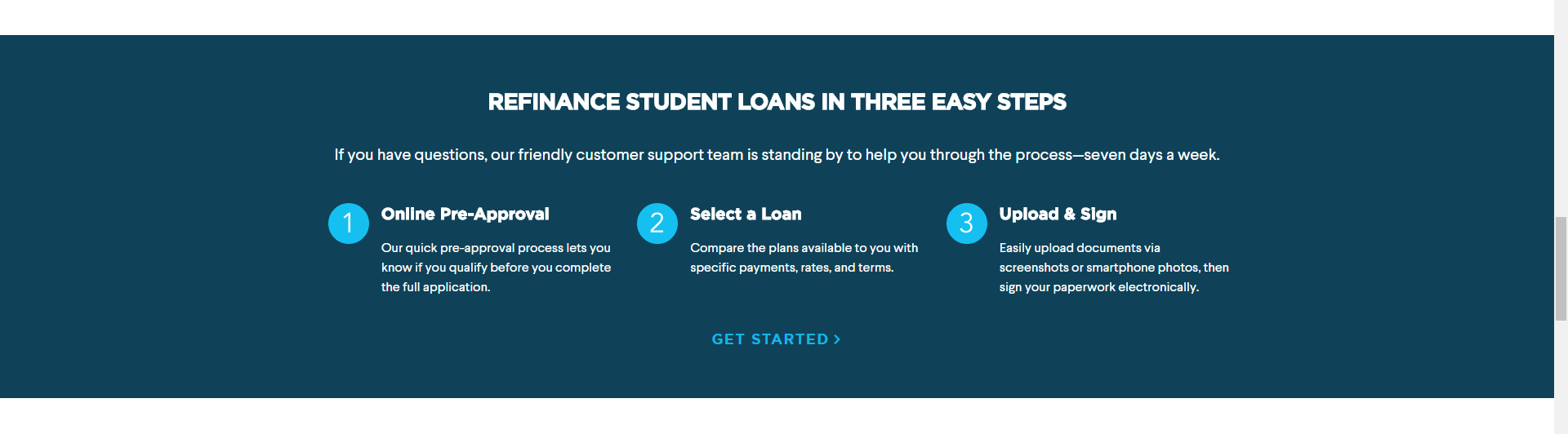

The process is simple. Once you create an account (name, email, password), it only takes 3 steps to get the job done:

- Online Pre-Approval- Fill out some basic information to let you know if you qualify before you complete the full application.

- Select a Loan- Compare available plans.

- Upload and Sign- Upload your documents via screenshots or smartphone photos, then sign your paperwork electronically.

If you just want to check and see what you can qualify for, you can simply create an account, fill out some basic info, and quickly find out what your options are without going through a huge application process. It literally takes 2 minutes!

What Kinds of Loans Does SoFi Refinance?

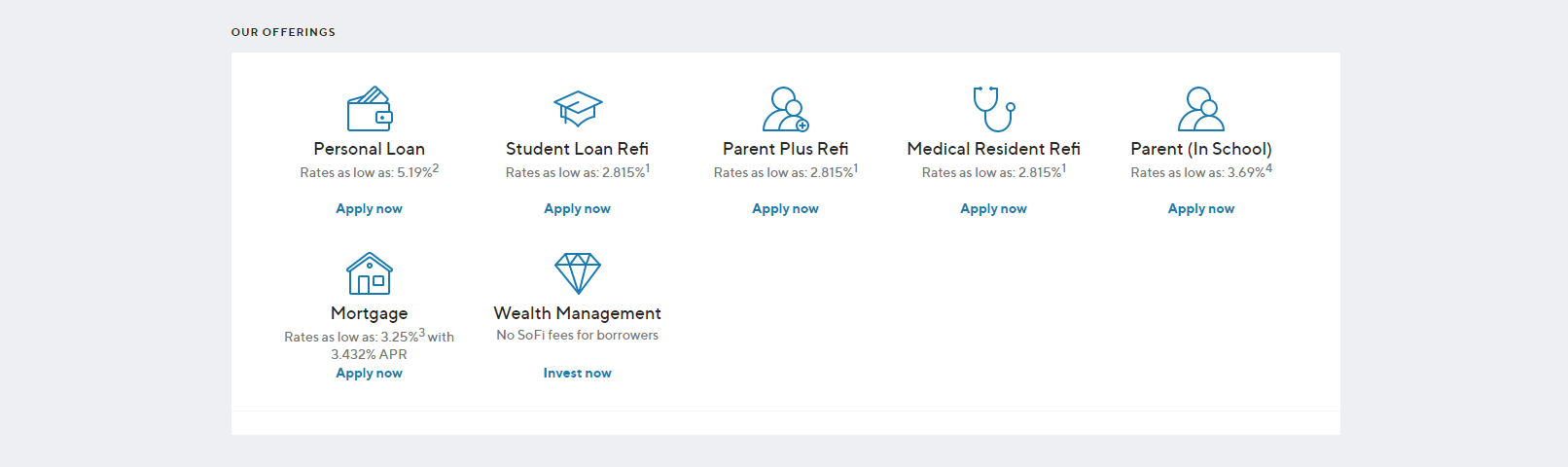

Here’s a quick rundown of the types of refinancing SoFi offers:

Parent Plus Loans

SoFi is one of the few lenders that allow you to refinance Parent Plus loans, transferring the loan from parents to the student. Of course, this takes pressure off your parents in their later years, but now you get the responsibility instead. This comes in especially handy if your parents come into hard financial times.

Medical Resident Refinance

Doctors can refinance their student loans with SoFi during residency or fellowship. They pay only $100 for up to 54 months. The loan’s interest will continue to accrue during this period, but it doesn’t compound. Therefore, the overall amount of the total loan will increase, as the $100 payment won’t make much of a dent on the accruing interest.

Student Loan Refinance

SoFi is the rare lender who can refi and consolidate federal and private loans. If you have several loans from several different sources, SoFi makes it easy to combine high interest, budget killing loans into one lower interest loan with a lower payment.

If the unexpected happens, they also offer mortgage protection. They will pause your payments and help you find a job if needed.

Get a Mortgage Through SoFi

SoFi also offers mortgage loans with some unique features:

- You can put as little as 10% down without having to pay PMI- a HUGE money saver!

- No origination fees.

- Never any application fees.

- No penalties for pre-payment.

- Get pre-qualified in just 2 minutes without affecting your credit score.

Other Loans

They also offer personal loans and student loans for parents with kids attending college. However, since I don’t ever recommend taking out any loan other than a reasonable mortgage, I won’t cover those here.

How Much Money Can You Save?

The average student loan borrower who refinances with SoFi saves $288 a month on payments, and $22,359 overall.

Get a $100 Welcome Bonus!

Advantages of Using SoFi to Refinance Student Loans

There are several distinct advantages to using SoFi to refinance your student loan debt. In addition to saving money:

- They are one of the few lenders that handles federal and private student loan consolidation.

- You get access to career coaching and advice (more about that below).

- Excellent customer support you probably aren’t getting with your current loan providers.

- You get a .125% rate discount on any additional loans, just for being a member.

Disadvantages of Using SoFi

There are a few disadvantages to refinancing your student loans that may cost you, so check your loan documents from your current lenders to see if refinancing will cost you in any way.

SoFi Doesn’t Accept All Borrowers

Unfortunately, SoFi has certain qualifications they’re looking for in order to refinance your student loans. Generally, they are looking for people with large loan balances, a higher income, and a good credit score.

Also, you need to be employed or have a job offer to start in the next 90 days and currently be in good standing with your student loans.

Fortunately, the readers here at CFF tend to fit that profile, which is one of the main reasons I wrote this article!

The SoFi Community Offers Extraordinary Benefits

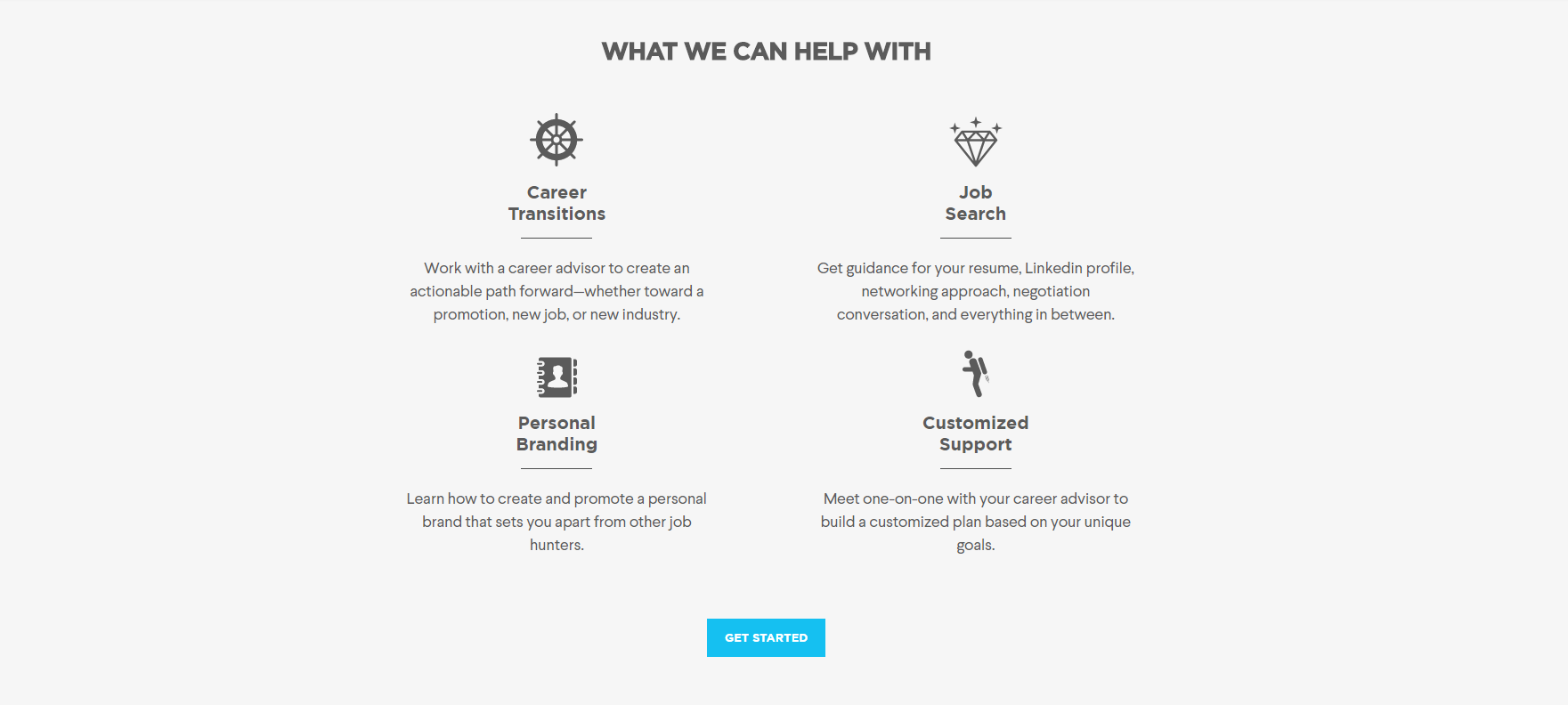

As a member of the community, you get benefits you’d never get anywhere else, such as:

- Help with career transitions- work with a career advisor toward a new career, promotion, or switching to another industry.

- Job Search- Help with your resume’, LinkedIn profile, negotiations, etc.

- Personal Branding- Learn to create a personal brand, setting you apart from the average job hunter.

- One-on-one coaching- Meet with your career advisor. Build a customized plan to meet your personal goals.

- Networking events in cities across the country.

Get a $100 Welcome Bonus!

The SoFi Entrepreneur Program

SoFi also offers a unique program for entrepreneurs, providing seed capital, an accelerator program, and even a demo day for your company if it qualifies.

You’ll have to fill out an application and be accepted into the program. If you’re accepted, you’ll get access to some awesome resources to help you grow your company:

- Seed Capital- SoFi will invest in your company.

- Access to the Community- Get access to the SoFi community to share your company.

- Mentorship- Advice and help to grow your company.

- Resources- Tools you need to operate more efficiently.

- Access to Investors- The opportunity to pitch to top VC’s and Angel investors at SoFi’s Demo Day.

SoFi Offers More Benefits

In addition to everything I’ve already mentioned, they also offer additional products that fit into your overall financial picture:

- Wealth Advisors- No commission, low fee, live advisors to help you reach your financial goals.

- Life Insurance- Affordable Term Life insurance up to $1 Million.

- Investment Opportunities- Qualified purchasers can invest directly into SoFi’s portfolio of prime consumer credit.

They Have a Referral Program!

One cool feature of SoFi is that they have a referral program you can take advantage of. For every friend you refer who refinances their student loans or Parent Plus loans, you get $300 and they get a $100 welcome bonus!

All you have to do is make sure they use your unique affiliate link which you’ll find in the Refer a Friend section of your SoFi dashboard. Just click the blue Share button to get your unique link to share with your friends and family.

Here’s mine: sofi.com/share/495420

A Bit of Advice to Avoid Student Loans

Student loan debt is a huge problem in this country affecting millions of people to the tune of over $1 Trillion in outstanding debt. This debt is keeping too many people in a perpetual state of bondage. As a result, they have trouble buying a house, affording a vehicle, and investing money for the future. Student loans are hurting our families, our prosperity, and our freedom to live as well as we like.

It’s a sad state of affairs…

I was very blessed to go to undergrad and Dental school without student loans because my parents planned well and were great at saving money. Because of their incredible example, I’ve made it a priority to pay cash for all three of my wife’s college degrees, as well as tuition for both of my kids who are currently in college.

If you are a parent and want to send your kids to college one day, start saving NOW! It’s not hard to do if you make it a priority. It will pay huge dividends for your kids and their future families to avoid the terrible bondage so many endure on a daily basis.

Get a $100 Welcome Bonus!

Question: Have you used SoFi to refinance your student loans? What was your experience?

Additional Resources:

The Top 10 Lies About Money That Keep You in Debt

[…] are highly rated and have helped thousands pay off their student loans faster, saving a ton of money in the […]